Mega-whale sparks market shift

A mysterious Bitcoin whale, controlling assets worth over $11 billion, has shifted billions into Ethereum, signalling a wider rotation in the cryptocurrency market. The investor’s move has propelled their Ether holdings above those of SharpLink Gaming, the second-largest corporate Ether treasury, highlighting growing institutional confidence in Ethereum.

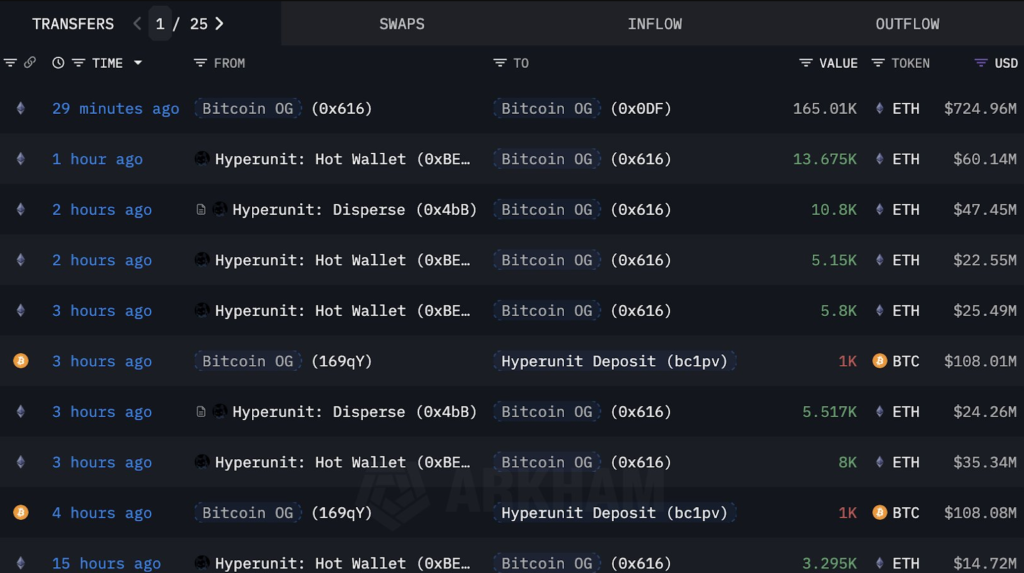

Billions moved into Ether

According to blockchain tracker Lookonchain, the whale sold $215 million in Bitcoin at a price of around $108,715 per coin to acquire $216 million in spot Ether at $4,391 on the decentralised exchange Hyperliquid. With this latest transaction, the investor now holds 886,371 Ether valued at over $4 billion.

The whale began reallocating funds on 21 August by liquidating $2.59 billion in Bitcoin to purchase $2.2 billion in Ether and a $577 million Ether perpetual long position. Last week, the investor closed $450 million of that long position at an average Ether price of $4,735, securing $33 million in profit before buying another $108 million in spot Ether.

Institutional accumulation on the rise

The whale’s aggressive rotation has influenced other major players. Reports suggest that nine additional whale addresses collectively bought $456 million worth of Ether last Wednesday. Analysts see this activity as part of a “natural rotation” towards Ethereum and other altcoins with higher growth potential.

Nicolai Søndergaard, research analyst at crypto intelligence firm Nansen, noted that Ether is benefiting not only from individual whales but also from “growing corporate accumulation.” He suggested that this trend reflects institutional investors’ willingness to diversify beyond Bitcoin.

Surpassing corporate treasuries

With holdings now valued at over $4 billion, the whale has overtaken SharpLink Gaming, which holds more than 797,000 Ether worth $3.5 billion. SharpLink has long been recognised as the second-largest corporate holder of Ethereum.

The whale’s position still lags behind Bitmine Immersion, the leading corporate holder with 1.8 million Ether valued at over $8 billion, according to strategicethereserve.xyz. Still, the shift illustrates how individual investors can now rival or even outpace corporate treasuries in scale.

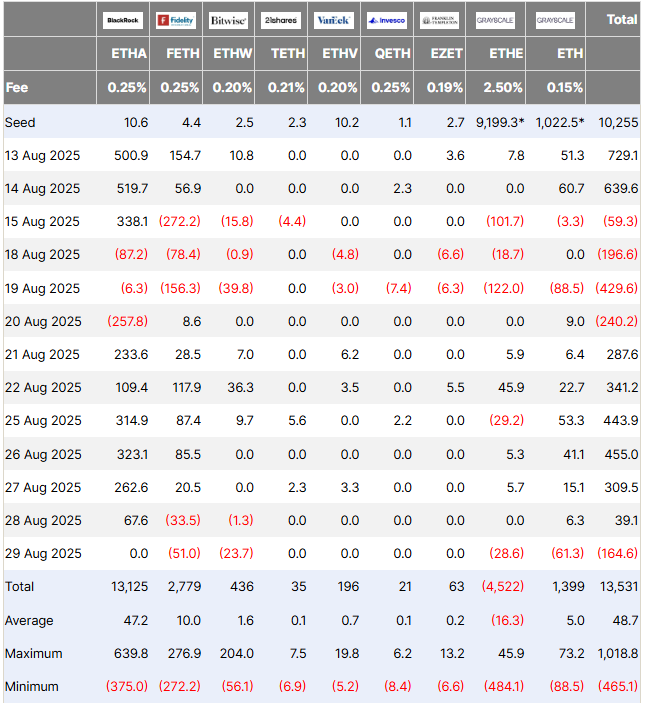

ETF inflows boost Ether demand

Adding further fuel to Ethereum’s momentum, spot Ether exchange-traded funds (ETFs) have attracted more than $1.8 billion in inflows over the past five trading days, according to Farside Investors.

Iliya Kalchev, dispatch analyst at digital asset platform Nexo, remarked that the trend is part of a larger structural shift. “Institutions are clearly broadening their scope beyond Bitcoin. Short-term moves will continue to hinge on macroeconomic releases, but the drivers of adoption, institutional inflows, and tokenised finance remain intact,” he said.

A market rotation in motion

The whale’s moves, combined with ETF demand and corporate interest, point to a growing recognition of Ethereum’s long-term potential. Analysts say that while Bitcoin remains dominant, Ethereum’s expanding role in tokenisation and decentralised finance is drawing both retail and institutional capital.